indiana estate tax form

Get and Sign St 105 2017-2022 Form. Does indiana have an inheritance tax or estate tax.

Federal Estate Tax Return Madam C J Walker Indiana Historical Society Digital Images

Contact an indianapolis estate planning attorney.

. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption. Refunds are issued in a matter of days. This form is for income earned in tax year 2021 with tax returns due in April 2022.

If you need to contact the IRS you. 2020 Individual Income Tax Forms. We last updated the Affidavit of Transferee of Trust Property that No Indiana Inheritance or Estate Tax is Due on the Transfer in October 2022 so this is the latest version of Form IH-TA.

November 10 2022 1842. Claim for Refund - Inheritance and Estate Taxes. Printable Income Tax Forms.

Instructions for Inheritance Tax General. Please read carefully the general instructions before preparing. The easiest way to complete a filing is to file your individual income taxes online.

The Indiana Department of Revenue does not handle property taxes. And it is safe and secure. The inheritance tax return must be filed with the probate.

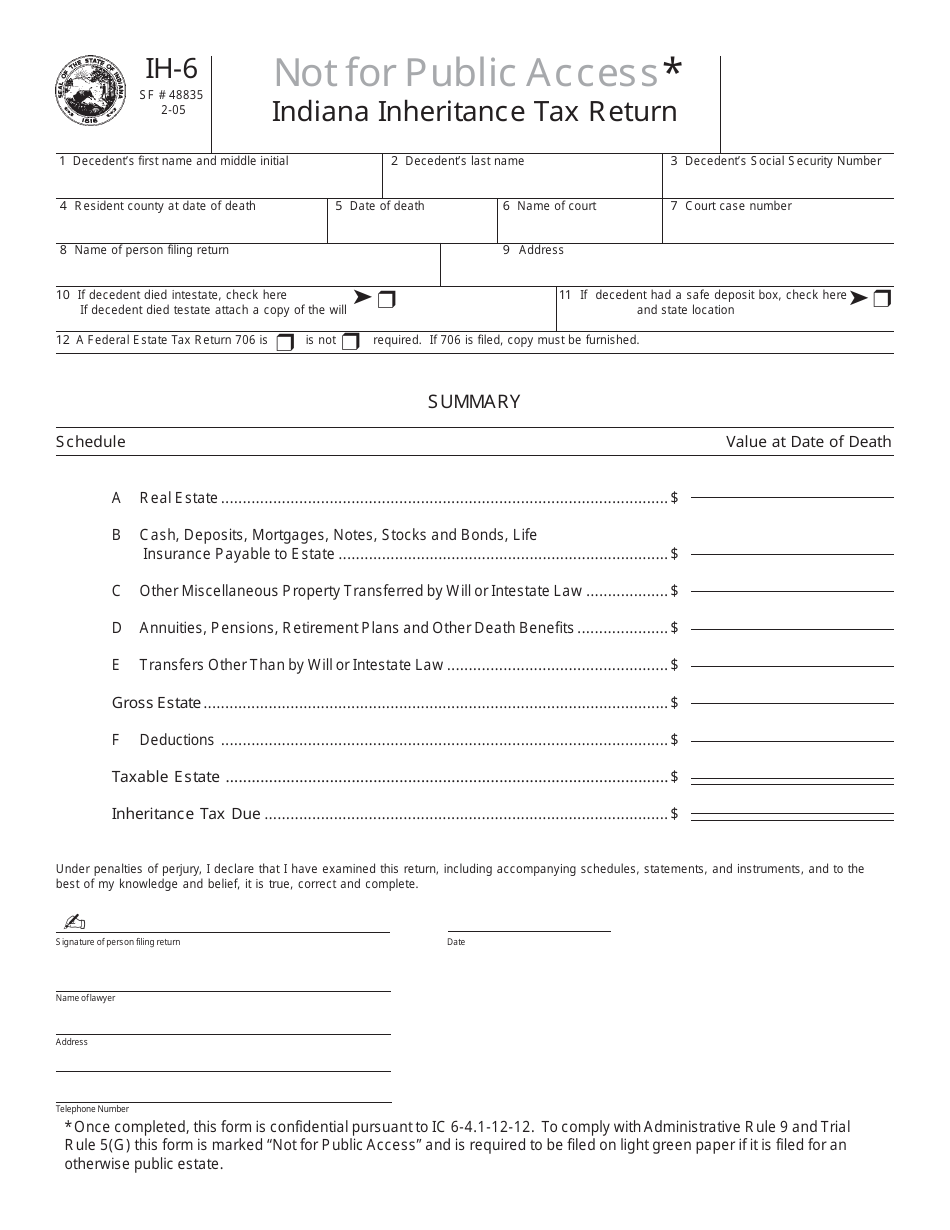

Form It20np State Form 148 Indiana NotForProfit Organization from. Prescribed by the Indiana Department of State Revenue InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note. Form IH-5 Prescribed by the Indiana Department of Revenue.

Indiana Inheritance Tax Return. Where do I go for tax forms. Child Services Department of DCS Disability Rights Indiana IDR Family Social Services Administration FSSA Governors Planning Council for People with Disabilities.

We will update this page with a new version of the form for 2023 as soon as it is made available by the. Indiana Form IT-40X Amended Tax Return for Forms IT-40 IT-40PNR or IT-40RNR Use this form to amend Indiana Individual Forms IT-40 IT-40PNR or IT-40RNR for tax periods. Get and Sign Np 20 Indiana Form 2018.

Returns are processed faster. Please direct all questions and form requests to the above agency. Instructions for Completing Form WH-4 This form should be completed by all resident and nonresident employees having income subject to Indiana state andor county income tax.

Get and Sign Application for. Individual tax returns and payments originally due by April 15 2021 are now due on or before May 17 2021. Therefore you must complete federal Form 1041 US.

There is no estate tax in indiana. In Indiana aircraft are subject. 48845 Employees Withholding Exemption County Status Certificate fill-in pdf WH-4MIL.

State Form 48834 R32-19 CLAIM FOR REFUND OF INHERITANCE AND ESTATE TAXES Name of Decedent Social. Indiana has a state income tax of 3230. Annual Withholding Tax Form Register and file this tax online via INTIME.

Get and Sign Indiana Business Tax Forms 2018-2022. Tax can be complicated but there are some basics that it often pays off to know. Find forms online at our Indiana tax forms website order by phone at 317-615-2581 leave your order on voice.

Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41. Form to be filed by executors of an estate and other persons required to file Form 706 or Form 706-NA to report the final estate tax value of property distributed or to be.

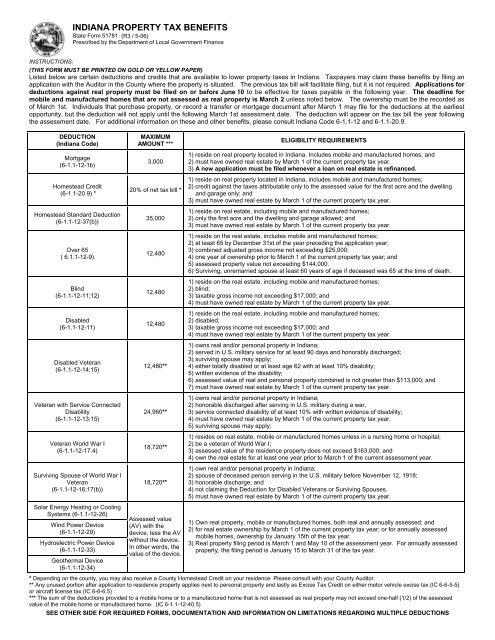

Indiana Property Tax Benefits State Form 51781 Town Of

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

2022 State Tax Reform State Tax Relief Rebate Checks

Estate Tax Rates Forms For 2022 State By State Table

How To Prove Funds Are Inheritance To The Irs

Complete Guide To Probate In Indiana

Indiana Estate Tax Everything You Need To Know Smartasset

Income General Information Department Of Taxation

Sentence Modification Form Indiana Fill Online Printable Fillable Blank Pdffiller

Filing Taxes For Deceased With No Estate H R Block

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Do I Need A Tax Id Number For An Estate

Irs Form 56 Instructions Overview Community Tax

Form Ih Ta Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer

Quitclaim Deed Indiana Form Fill Out And Sign Printable Pdf Template Signnow

2021 State Corporate Tax Rates And Brackets Tax Foundation

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Complete Guide To Probate In Indiana

Form Ih Ta Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer